In fact, firms that use Karbon save an average of 16.5 hours per week, per employee. With fixed-fee pricing, the more work you can do in a day directly correlates to an increased profit. A lot of industry theory compliance work is being expedited and in some cases completely automated. If you’re saving a lot of time and it doesn’t translate into more profit, then something needs to change.

We always ask our list of consultants to tell us about other aspects of their business. Performance deals are when you are paid based on the performance and outcome you have created during the project. One of the highest ROI moves you can make is switching to value-based fees. There are many different ways to price your various consulting offers. In this must-read report, you’ll discover the pricing secrets of the industry’s top earners. But there is no better method for raising your rates and creating more value.

Get in Touch With a Financial Advisor

- However, remember that this kind of pricing still excludes the true value of your work.

- Being an accountant can mean far more than preparing tax returns, compiling financial statements, handling technical compliance work or providing back-office accounting services.

- Different consultants offer different services and have different areas of expertise.

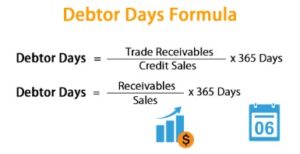

For example, Indeed reports that accountants in Houston, Texas earn an average of $65,832 per year compared to $70,533 in Los Angeles, CA. If you offer virtual services to clients, consider their location and whether you need to adjust your fees accordingly. Before deciding which pricing structure you want to use, consider factors like whether your services are ongoing and how much time you spend with each client. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. While there are many benefits to hiring an accounting policies definition examples accounting consultant, businesses must also consider the costs.

How to Price Your Consulting Services

Value-based and fixed-fee billing are good for maintaining a consistent cash flow, because you can quote and even bill upfront. But if you’re still committed to hourly pricing, placing time frames on the payment of invoices is the bare minimum. The old maxim, “You get what you pay for,” doesn’t apply to consulting work anymore. But here are some basic tips to help you negotiate your hourly consulting rate and take advantage of this new era in the global economy.

Championed by pricing expert, Ron Baker CPA, this model has the potential to upend and revolutionize value pricing. Usually, that will involve a discovery meeting to determine what a potential client is looking for, how often, and exactly what your scope will be. You discover what areas they need your help with, learn the possible difficulties with their accounts, and build relationships through more meaningful dialogue.

Do Consultants Work With Employees Or Contractors

Doing so sends the wrong signals to the client about your value, and what you can do for their business. What’s changed over the past how do the paid interest expenses present in the statement of cash flow 4 years on the topic of consulting fees? Here are some of the trends we’re noticing based on the data.

Although we’re here to bring you some quick fee-setting tips, the process itself probably won’t be lightning fast. Go ahead and take your time setting your prices to ensure you bill clients fairly. When it comes to setting your professional fees in accounting, there are a number of factors that come into play. You might decide to create tiers for small, medium, and large business clients.

How Much Does An Accountant Cost In 2024?

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. Checking a consultant’s references and reviews is always a good idea. These can provide valuable insights into the consultant’s reliability, competence, and professionalism. Businesses should consider the consultant’s qualifications and experience when choosing an accounting consultant. Communication is critical when working with an accounting consultant. If communication channels are not clear and compelling, it could lead to misunderstandings and inefficiencies.

CPA-licensed accountants charge on average between $200 – $400 per hour in the US. A $200 per hour difference doesn’t tell you all that much about how to build your accounting firm’s pricing model. Calculating an accountant’s costs goes beyond comparing national averages. You’ll need to consider factors directly affecting your business and the accountant’s services. Some firms also charge ancillary fees on top of their hourly rates.