Jessica Brita-Segyde

Manufactured belongings and you will modular house aren’t written equivalent at least not regarding direction regarding a house bank. Mortgage loans to possess are built house features a special selection of underwriting criteria than others out-of standard home. Knowing the differences can help you get ready for your upcoming mortgage application and after that house lookup. Or if perhaps you may be merely right here to have standard education, you can sound extra smart at the parties!

Reasonable warning: This topic are full that have contradictory conditions. Dependent on your residence financial and you may mortgage program, the latest words manufactured and you can modular enables you to suggest different things or the same task. This web site will dump the words since the obviously more but often know times the spot where the elizabeth. Mislead? Keep reading for most clearness and a better understanding of as to the reasons this is exactly for example good nuanced topic.

Design Principles

The most effective difference in the 2 household models Ridgway loans is the fact standard land need certainly to experience on a trailer on their finally address, while manufactured property are formulated on a frame that will journey behind the brand new truck. It might see, therefore, that two structure appearance are easy to differentiate. However, so it important differences is not always very easy to place throughout the road. Standard home are formulated offsite, following transferred to their new target. Are produced belongings manufactured offsite, upcoming gone to live in their brand new target. The difference lies in the foundation: standard house must be permanently secured while were created homes you can expect to still has rims the lower that can officially become gone to live in a different sort of venue.

Now that we now have protected the fundamental difference between standard and are available homes, listed below are much more parallels. Those two home appearance can be found rurally otherwise within this a community. Both have been made in a manufacturer prior to are transported to their newest venue. Neither is considered site-built or stick-founded. Each other enjoys limitless selection away from square video footage, floors plan, and you can finish functions. A trained appraiser could make the last telephone call out-of if or not a good domestic is classified as the modular otherwise are created to possess underwriting purposes.

Loan Differences

Old-fashioned Recommendations: Conventional money are those supported by quasi-governmental entities such Federal national mortgage association and you may Freddie Mac computer. Talking about also known as Bodies Backed Enterprises (GSE’s). The newest underwriting recommendations established of the GSE’s are often equivalent. Particular nuanced variations carry out are present, but that’s a topic for another web log. A skilled mortgage officer can ascertain the differences and certainly will pertain their unique training to each unique application.

On the purposes of this website, here you will find the standard traditional assistance to possess modular and you can are produced housing: To possess standard home, the newest GSE’s postponed to HUD’s recommendations. Old-fashioned loans require one to any standard family feel oriented based on HUD’s Federal Are manufactured House Structure and you can Safeguards Criteria. If state-top design standards exists, men and women can be put instead. Mention the difference inside the conditions here: That which FHA loan providers phone call manufactured are precisely what the traditional loan providers phone call standard. Traditional financing officials may also utilize the identity factory-built whenever revealing modular property. Old-fashioned loan providers dont place of many tangible conditions and terms into modular home and you can generally cure him or her given that web site-depending belongings away from a keen underwriting angle. The largest inserting area is the assessment. A normal underwriter have a tendency to count heavily on the appraiser’s thoughts out of quality when choosing whether to lend to your a modular house.

Are formulated house can be qualified to receive a normal loan. Number 1 homes and you can second homes meet the criteria. Financing qualities commonly eligible for a produced financial via traditional applications. Single-broad property are usually ineligible but can getting recognized if the property is based in a local especially endorsed to possess unmarried-greater old-fashioned are produced mortgage brokers.

Va Advice: The usa Agency out of Veteran’s Products (VA) loan program have a certain band of underwriting criteria offered merely offered to Unites states services people as well as their spouses. Virtual assistant funds limit the settlement costs which are energized in order to the customer and require little down payment. Va funds identify you to a home must satisfy minimum standards out of marketability (we.age., our home can’t be when you look at the disrepair).

The Va snacks are created and you can modular belongings independently, and it surely will lend to your each other household brands, considering certain underwriting criteria is met. To own modular land, Virtual assistant underwriting uses typical mortgage assistance, that’s available here. To have are available belongings, a number of more conditions and terms exists. The structure can be used since the a long-term household and stay affixed so you can a long-term foundation. A great Va mortgage may also be used buying a great deal getting a made home, given our home one to sooner or later appear would be affixed so you’re able to an effective permanent foundation. Are available residential property have to screen their HUD tag, indicating which they was indeed mainly based adopting the bodies criteria. Va loans to possess are formulated construction may have shorter words (fifteen 23 decades as opposed to 30).

It’s important to notice right here not every Va lenders are required to generate fund to your are formulated houses, so check with your Virtual assistant mortgage manager prior to starting an application.

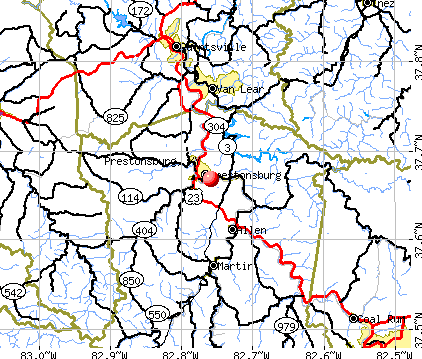

USDA Recommendations: The united states Department out-of Agriculture (USDA) financing program was designed to encourage credit within the rural areas. The program intentions to create homeownership easy for property that have low so you’re able to modest profits. The fresh new and you may made use of modular and are produced residential property meet the requirements, provided that the niche possessions really does or commonly take a seat on a good long lasting base. Are manufactured property tends to be single- otherwise double-greater however, at least eight hundred sqft becomes necessary having a great USDA financing.

FHA Direction: FHA fund are the very perplexing of parcel. The new Agencies out-of Houses and you can Urban Advancement (HUD), that provides Government Houses Administration (FHA) insurance, usually ensure one another modular and you may manufactured homes. Is where in fact the reasonable alerting off more than will be: HUD phone calls standard, are manufactured, as well as mobile home the exact same thing just after they are considered insurable. Based on HUD, many of these domestic versions you can expect to sooner or later become underwritten because are built. Any low-site-founded house you will definitely belong to HUD’s manufactured direction immediately following told you household could have been connected to a permanent basis. In the event the a property are permanently attached, it may be an applicant to possess an FHA financing so long while the a lot more guidelines is actually met: were created house need to have already been built immediately following June 15, 1976. Were created land should have 400 or even more sqft regarding liveable space and ought to become categorized just like the a house and not private property to satisfy FHA underwriting conditions. Needless to say, home nonetheless for the a frame otherwise home which have tires underneath you will definitely commercially become went. Instance dwellings aren’t considered a house consequently they are thus ineligible getting FHA money.

Generally, FHA funds have less restrictions than just antique money but require you to the buyer shell out a month-to-month home loan insurance premium in order to offset the risk.

Exotic or even in-House Guidance: Talking about finance that are directly underwritten and funded by your bank. These types of money is actually strange and certainly will trust the new lender’s own underwriting direction.

Next Learning

This web site discusses loads of floor. Modular and are produced home loans try nuanced and you may complicated. This is certainly ironic, considering the simplicity that such dwellings are formulated. When you find yourself searching for a modular or manufactured home loan and wish to realize then, are the next tips: